estate tax exemption 2020 sunset

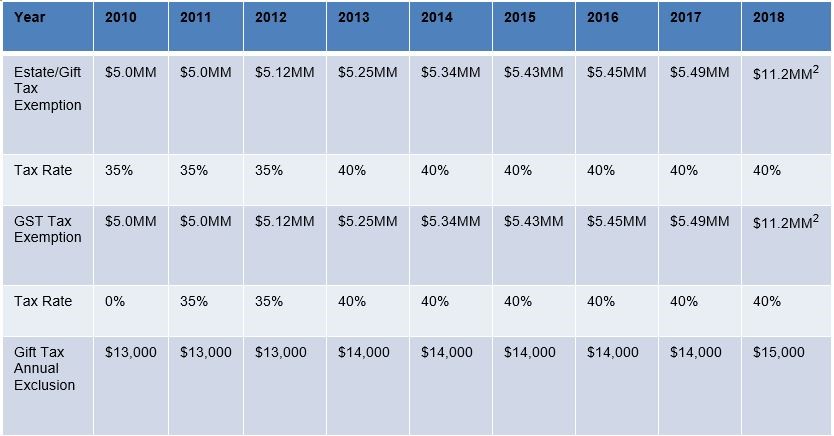

In 2018 the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemption to 1118 million from 56 million. The estate planning environment has changed over the last decade.

Estate Tax In The United States Wikipedia

The federal estate tax exemption is set to sunset at the end of 2025 but the impact of a global pandemic and the presidential election will likely accelerate the rollback.

. The estate-tax exemption rose to 1158 million in 2020 180000 higher than the year before to account for inflation. The 2022 exemption is 1206 million up from 117 million in 2021. With the federal gift and estate tax lifetime exemption amount currently set to sunset and return to pre-Tax Cuts and Jobs Act levels in.

This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. The estate-tax exemption rose to 1158 million in 2020 180000 higher than the year before to account for inflation. 2020 at 416 am.

Under the current law this increased exemption will sunset at. However the TCJA will sunset. The law left an open question as to whether a gift made using the increased federal estate tax exemption would be taxed at death if the person died after the exemption sunsets.

The top marginal Minnesota estate tax rate remains at 16. With adjustments for inflation that. With adjustments for inflation that exemption in 2020 is 1158 million the highest its ever been reports the article federal estate tax.

In 2018 the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemption to 1118 million from 56 million. By Jack Aguillard. The Ohio Estate Tax was repealed effective January 1 2013 and a sunset provision has been added.

With that exemption level indexed annually to inflation the current. In 2018 the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemption to 1118 million from 56 million. After that the exemption amount will drop back down to the prior laws 5 million cap which.

The official estate and gift tax exemption climbs to 1206 million per individual. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. The Tax Cuts and Jobs Act doubled the estate tax exemption up to roughly 11 million per person.

However the TCJA will sunset. With adjustments for inflation that. Your estate wouldnt be subject to the.

The first 1206 million of your estate is therefore exempt from taxation. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. After 2025 the exemption amount will sunset a fancy way of.

Effective January 1 2022 no Ohio estate tax is due for property that is first discovered. The current estate tax exemption is set to expire at sunset. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years.

Nearly every democratic presidential. The current estate and gift tax exemption is scheduled to end on the last day of 2025. The federal estate tax exemption is set to sunset at the end of 2025.

Active Duty military personnel or veterans may also qualify for tax breaks as well. As of January 1 2020 the Minnesota estate tax exemption amount will increase to 30 million up from 27 million in 2019.

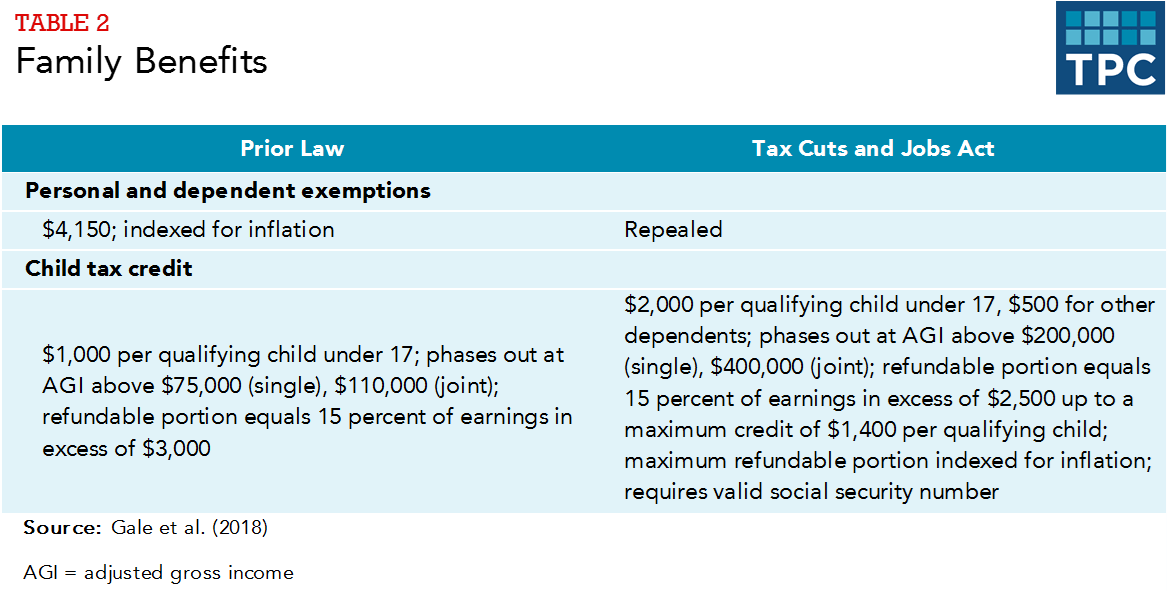

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Is This An Opportune Time To Gift Your Commercial Real Estate Holdings For Estate And Gift Tax Planning Purposes Westfair Communications

New York Estate Gift Tax Update 2020 Nys Gift Tax

Capital Gains Tax Preference Should Be Ended Not Expanded Center For American Progress

Preparing For The 2025 Tax Sunset Creative Planning

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Property Taxes And Living Trusts In California Los Angeles Estate Planning Attorneys

Charity In The New Estate Tax Environment How To Save Tax Deductions

The Generation Skipping Transfer Tax A Quick Guide

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Do You Pay Tax On An Inheritance

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

As The Tax Law Sunset Nears Review Savvy Gifting Solutions

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Estate And Inheritance Taxes Around The World Tax Foundation

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

Should Estate Reimburse Beneficiaries For Income Taxes Incurred